ARTICLE | Same but different: A comparison of the EU and US GSP schemes

The European Union and the United States are among the biggest traders in the world, both offering GSP preferences to a vast number of beneficiaries. While the main incentives of offering tariff reductions to lower-income countries are similar within the two schemes, there are differences in their practical implementation. This article aims to outline the most significant differences between the EU and US GSP schemes.

Established in 1971, the EU GSP is the older of the two schemes (the US implemented its own GSP in 1976). Following 10-year renewals, the current iteration of the EU GSP is set to expire on 31 December 2023. The European Commission is working on a new GSP regulation and recently published the Interim Report of the external study supporting its Impact Assessment on the review of the regulation. On many occasions, the US GSP was not renewed immediately after its expiry, however, upon renewal, tariff preferences could be requested retroactively. After having expired in December 2020, there is currently no preferential scheme in place from the US side, and no decision has yet been reached about its renewal.

Beneficiary countries and eligible products

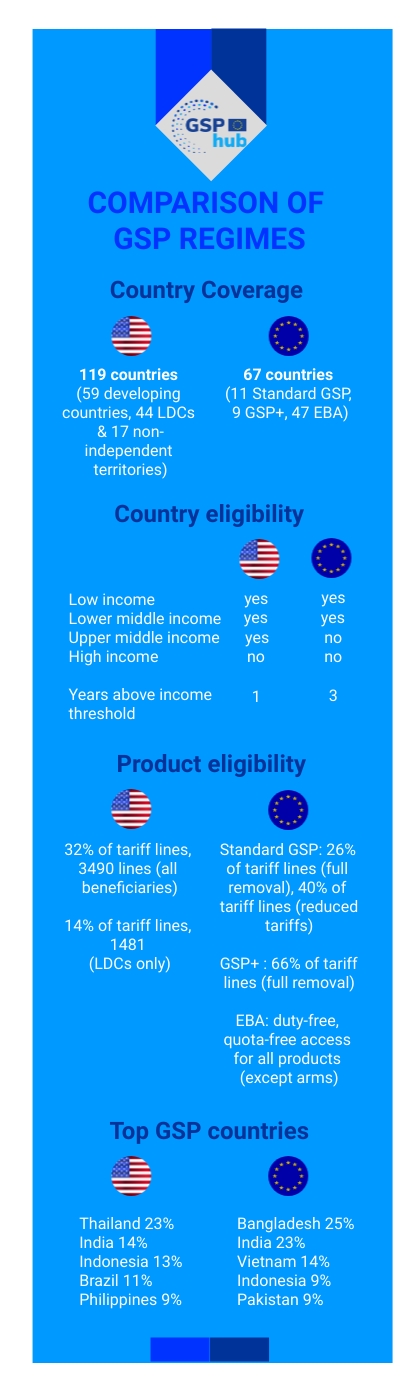

The EU GSP emphasises cooperation with lower-income partners, tailoring the GSP scheme to the needs and endeavours of beneficiary countries. This prompted the creation of the GSP+ and EBA (Everything But Arms) arrangements in addition to the Standard GSP, a three-tier structure unique to the EU scheme. Unlike the EU GSP, the US GSP grants preferences also to countries designated as higher-middle income countries by the World Bank, such as Thailand and Brazil. This results in a larger number of beneficiary countries: while 71 countries benefit from the EU GSP following its 2012 reform, the US GSP gathers 119 beneficiary countries and territories. The EU GSP is specifically targeted towards low and lower-middle-income countries (GDP below USD 3995, according to World Bank thresholds for 2019) supporting their integration into global supply and value chains. The creation of the EBA arrangement completely eliminating tariffs for least developed countries (according to UN classification) further strengthens this focus. In the meantime, around 1500 products are US GSP-eligible only when imported from LDCs. The US has additional arrangements in place that structure trade relations with developing countries. The African Growth and Opportunity Act (AGOA), for example, includes approximately 1800 additional items that Sub-Saharan African countries can export to the US while benefiting from tariff exemptions. Haiti also benefits from a similar arrangement under the Caribbean Basin Initiative (CBI).

The range of eligible products also differs between the EU and US GSP schemes. The US GSP is more restrictive - various products that are eligible for tariff reductions under the EU GSP are ineligible under the US GSP. The most prominent example in this regard is most textile articles and apparel, which are not eligible for tariff reductions under the US GSP scheme but constitute one of the most important product sections under the EU GSP.

Values and review

The EU and the US GSP schemes both consider the values aspect of the GSP to be key elements and include standards to effectively promote values in beneficiary countries. However, the exact international standards reinforced through the schemes and their implementation differ. For example, while both programs include a labour rights standard, the US GSP also includes a direct reference to intellectual property rights as a necessary standard that beneficiary countries must adhere to, which are not part of the EU GSP. On the other hand, the EU GSP+ provides certain GSP beneficiaries with additional tariff reductions as an incentive to ratify the 27 linked international conventions on human and labour rights, environment, climate and good governance. The GSP+ arrangement brings about a significant economic impact, as beneficiary countries are given additional tariff reductions and also a values-based impact, as these countries make additional commitments in the fields of human and labour rights, good governance, and environmental protection.

The EU and US arrangements both contain a review and enforcement mechanism. The EU GSP+ mechanism consists of a biennial report based on the monitoring and communication with beneficiary countries, which outlines outstanding implementation issues in beneficiary countries and builds on in-country monitoring missions. Preferences can also be temporarily withdrawn from all EU GSP beneficiaries on the basis of severe human rights violations. EU stakeholders can also use the recently established Single Entry Point to signal non-compliance with key EU GSP conditions. The US GSP accepts petitions from stakeholders and also proactively assesses all GSP beneficiaries on a triennial basis. Both processes can prompt a country review and can ultimately lead to the withdrawal of benefits for non-compliance with the GSP eligibility standards.

The EU GSP remains the biggest GSP scheme in terms of market access. GSP beneficiaries can enjoy significant tariff reductions (and in the case of EBA beneficiaries, a complete elimination of tariffs) in accessing the EU market of 500 million consumers, giving them an unparalleled opportunity for doing business with the EU.